In Focus – Fiscal and BOP outlook for Sri Lanka in 2025-2026

Outcome of Frontier's Mid-Year Views Review Process

Fiscal revenue continues to exceed expectations so far in 2025. Despite deflation, revenue keeps growing at a level well above non-interest expenditures of the government. The current account surplus is larger in 2025 than in 2024 so far, despite an influx of vehicle imports. What does all of this mean for the fiscal and BOP outlooks for the rest of 2025 and how will that impact carry over to 2026? That is the question we answer here.

These outlooks are the result of the mid-year review of our views that happened across June. It involved a dozen research team members diving into the data available and the trends compared to the past, followed by intense discussion of their views.

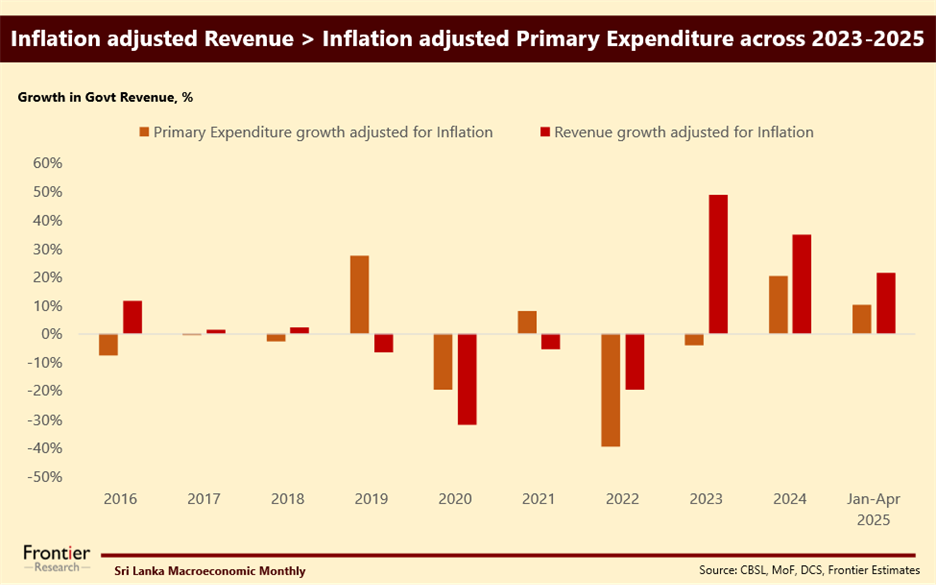

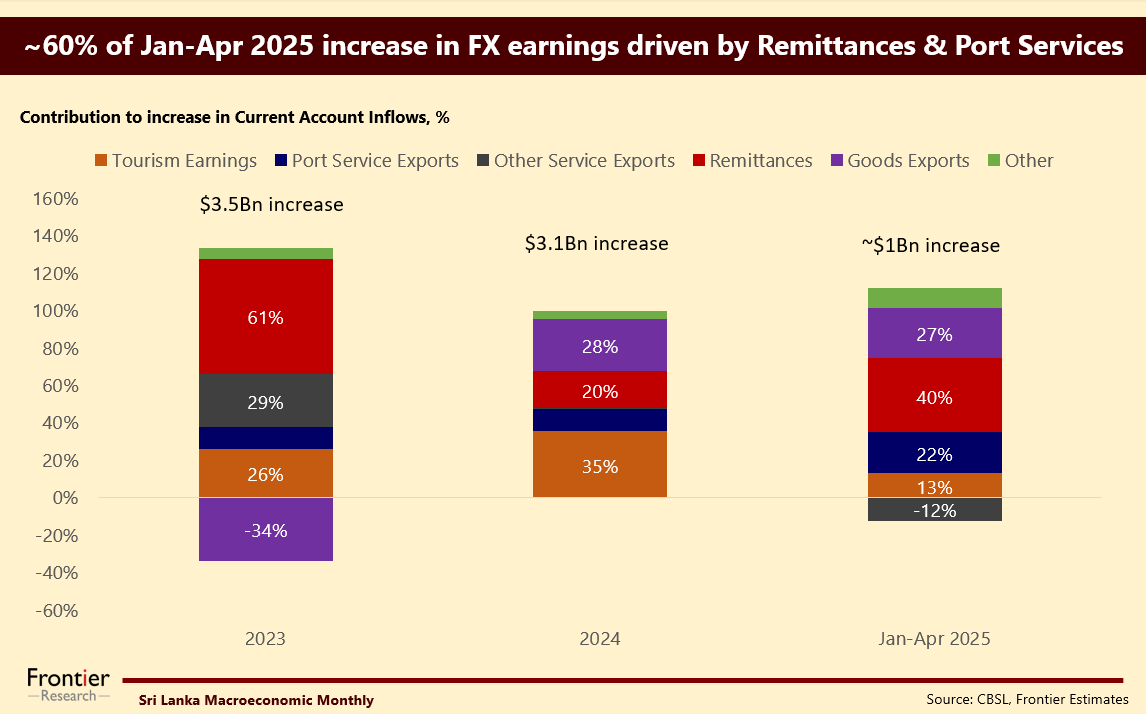

An example of the points that came up was the fact that revenue is continuing to growth YoY despite the lack of price inflation. It convinced the team that revenue growth is currently driven by robust economic activity and improved tax collection. Meanwhile non-interest or primary expenditure is growing, it is well below the growth in revenue. On the BOP side of things, the team pointed to the rapid growth in remittances and port services exports as key drivers of forex earnings in 2025 so far.

For those interested in the details, the Focus provides a clear explanation of why we have a largely positive Fiscal and BOP outlook for Sri Lanka across 2025 and 2026. If you are a client who has not had a chance to read through it, please click here. Otherwise get in touch with us to subscribe to our reports (clientconnect@frontiergroup.info).