In Focus - Fiscal and BOP outlook for Sri Lanka in 2025-2026

Frontier's End September Views Review Process

As a result of improved revenue collection and contained government non-interest expenditure, we expect Sri Lanka to record a current account surplus well above IMF’s target set for 2025. This surplus is higher than our previous expectations, even after taking into account some expenditure spikes during the end of the year. Sri Lanka’s Balance of Payments Current Account is also expected to remain in record surplus even amidst rising imports. What does all of this mean for the fiscal and BOP outlooks for the rest of 2025 and how will that impact carry over to 2026 is what we try to untie here.

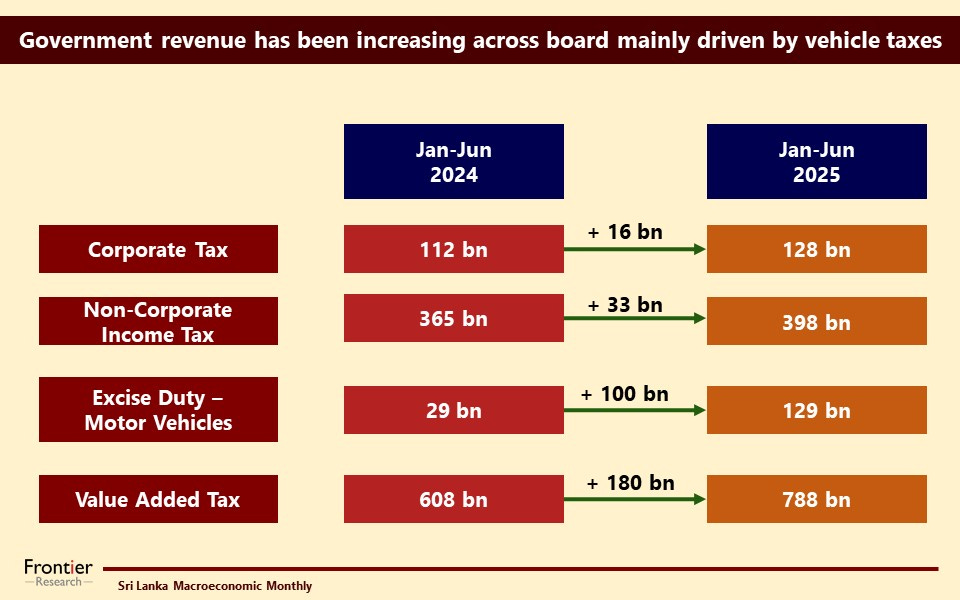

Both tax and non-tax revenue is expected to overperform the IMF target of 15% of GDP set for 2025. While vehicle taxes have played a significant role, we see all other taxes across the board - VAT, income tax and excise duties – contributing alongside improved tax compliance and administrative measures to drive up fiscal revenue. Expenditure on the other hand remains under control. Despite an overall increase in public sector salaries and transfers to households, we expect recurrent expenditure to be contained due to the shrinking public sector workforce and relatively lower interest costs in 2025. The government has heavily underspent on capital expenditure so far in 2025 compared to the same period last year but we would not rule out the possibility of a higher amount of capex spending being reported by the end of the year.

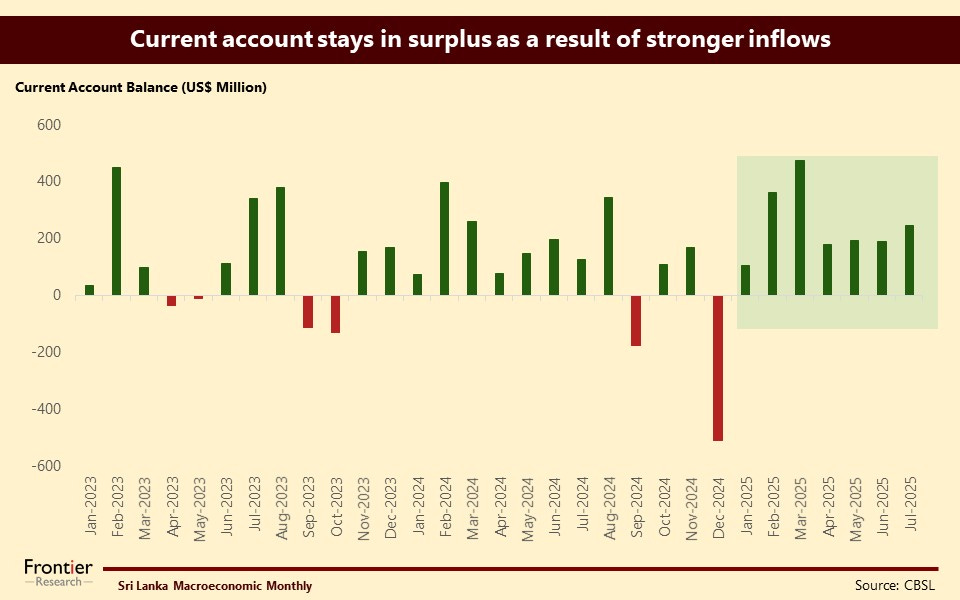

On the external front, the pick up in private sector credit on the back of low interest rates have driven up imports this year. While we expect overall imports to remain robust with the growth in economic activity, we see that the inflows to the current account – including worker remittances, port service flows, tourism earnings, and exports - offsetting the outflows assisting the current account to remain at record surplus levels seen so far.

Moving to 2026, we expect Sri Lanka to continue this strong positive momentum both on the fiscal and external fronts, indicating the possibility of recording twin surpluses for the fourth consecutive year and for those interested in the details, the Focus provides a clear explanation of why we have a largely positive fiscal and BOP outlook for Sri Lanka across 2025 and 2026.

These outlooks are the result of the end September update of our views. It involved a dozen research team members diving into the data available and the trends compared to the past, followed by intense discussion of their views.

If you are a client who has not had a chance to read through it, please click here. Otherwise get in touch with us to subscribe to our reports (clientconnect@frontiergroup.info).