While there has mainly been positive sentiment about the Sri Lankan economy, one area that doesn’t get highlighted a lot is the recovery in consumption alongside this. In our focus for this month, we analysed this, and our broad understanding is that alongside economic growth, there has been a pickup in income levels. In line with that, there has also been consumption growth. However, this growth is different from what Sri Lanka has seen in the past. This time around, it is not a “broad-based growth”, but rather a more concentrated one across a few specific areas and product categories.

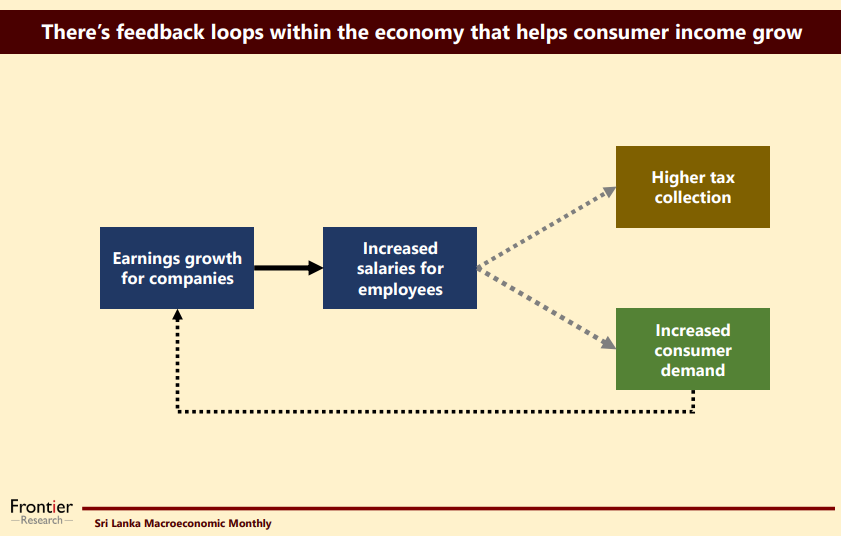

We believe this is stemming from the overall change in Sri Lanka’s economic structure, where growth is now being led by the private sector with increased availability of credit. This private sector-led growth directly benefits high-income categories much faster compared to the rest of the economy.

We believe this has created an opportunity for a rapid increase in disposable income relative to others. Looking at PAYE/APIT numbers for 2025, this is visible as well, with PAYE numbers revised down with an increased tax free threshold; PAYE numbers were expected to fall. But the actual numbers for 2025 indicate a growth on a YOY basis, while taxpayers’ numbers remained broadly flat. This again indicates a more robust income growth happening at the top end. Additionally, with the government spending less than what it used to in the past and it is no longer being the main “direct” driver of growth, this has further contributed to income growth being more rapid at the end.

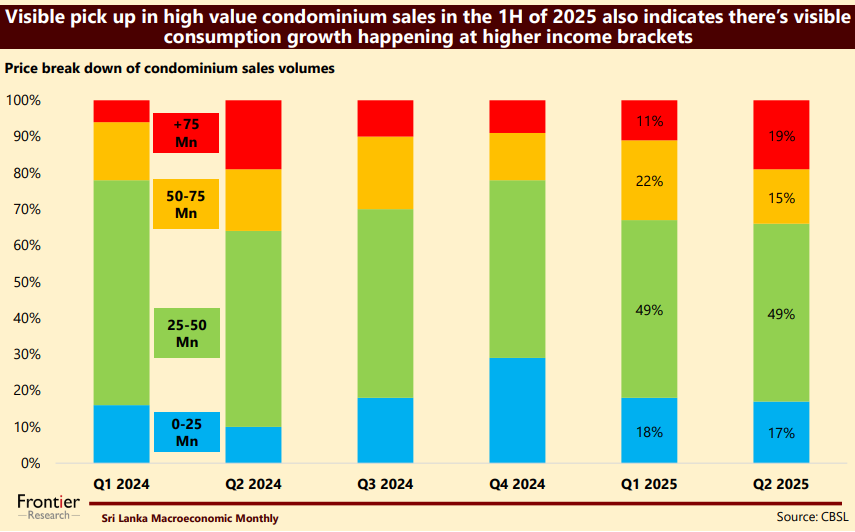

This level of income growth has directly benefited higher income groups with increased disposable income, and their consumption levels to risen significantly alongside this. The overall pickup in vehicle imports seen over the last few months, together with the rapid increase in high-value condominium sales, indicates that the growth in consumption we talked about earlier is happening at the top end.

Overall, we believe the rest of the economy is also seeing some level of income growth. However, the adjustment for these categories is much slower, as the crisis has eroded their consumption power. Hence, despite some income growth in these groups, a clear rebound in consumption has not yet occurred. It will likely require several more rounds of economic growth for this recovery to truly take hold. So we believe in the short term, consumption at the top end will continue to be a key factor driving economic activity in Sri Lanka, especially in Colombo and its suburbs.

For those interested in the details, the In Focus on Frontier Athena provides a deeper analysis of this topic with more information on how, within the income brackets as well, some areas within the country are seeing a more dramatic recovery, while the rest of the economy is seeing a slower recovery. Our clients would have received the report to their emails, and it is accessible on our Athena reports platform since 31st October. If you still haven’t had a chance to read through click here! If not, please get in touch with us for a trial subscription to our reports (clientconnect@frontiergroup.info).