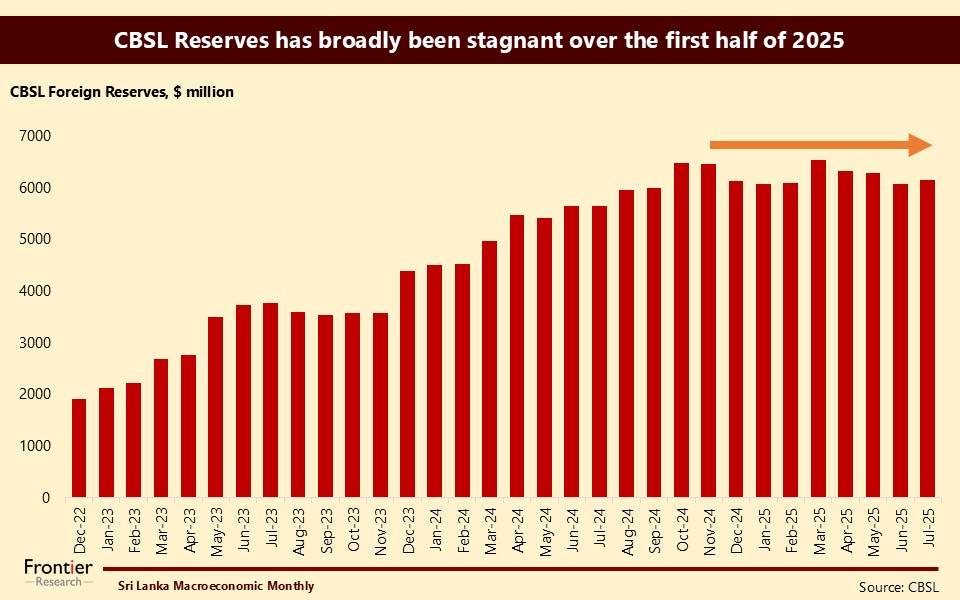

Despite majority of Sri Lanka's economic indicators showing positive growth, one particular outlier to this is reserves. With a significant current account surplus recorded in the first half, and a large amount bought by the CBSL to its coffers from that, still the reported Gross official reserves value by end-July is almost equivalent to the number recorded at end-December 2024.

Looking at why this has happened, one visible sign is that as much as there have been positive forces helping build reserves, there have also been similar forces depleting reserves during the period, such as external debt repayments for the ISBs and money paid down on the ACU swap. All of these combined have played a role in nullifying each other, broadly keeping the reserve value stagnant across the period.

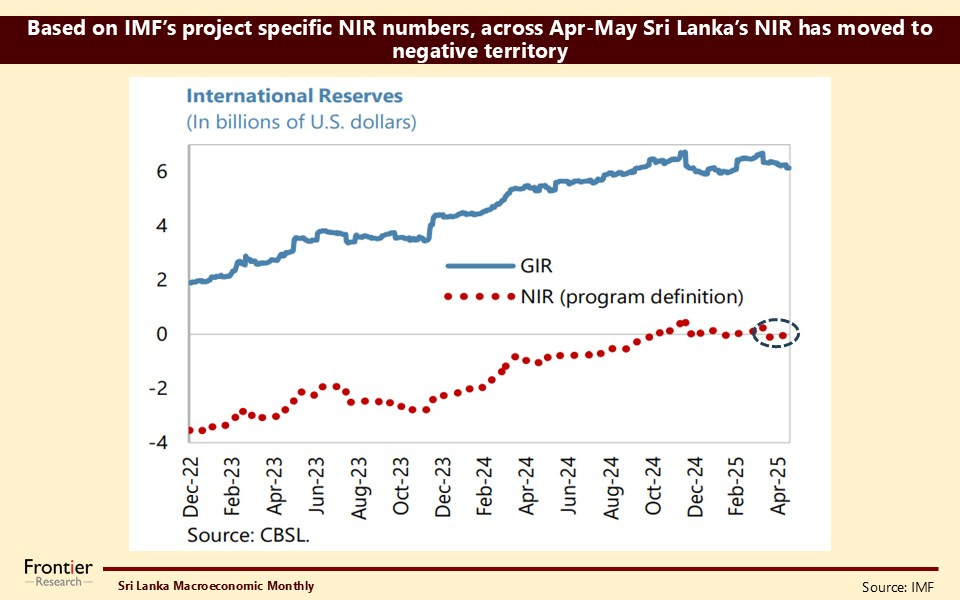

In terms of the IMF program, they don’t have targets set on Gross Official Reserves; rather, they have targets on Net International Reserves, which is an adjusted value to account for reserve-related liabilities on the gross official reserves, including ones the CBSL has with domestic banks.

Looking at this and the reported values based on the IMF reports, it appears that so far Sri Lanka has comfortably met these targets until mid this year. While these targets had expected the Net International Reserves to be in deficit across the period, for the majority of those targets, the actual result has been that Sri Lanka actually had a positive balance.

Going forward, the Net International Reserves targets set by the IMF for end Dec-2025 and Jun-2026 are in the positive territory, creating a tighter space for the CBSL to manage reserves. Therefore, keeping this in mind, in the upcoming period, the FX inflows into reserves and outflows from reserves will become particularly important elements to watch out for.

For those interested in the details, the In Focus on Frontier Athena provides a deeper analysis of the specific factors that kept reserve balances stagnant, along with Frontier’s perspective on how the upcoming Net International Reserves target could affect the broader economy, including its impact on the exchange rate. Our clients would have received the report to their emails and is accessible on our Athena reports platform since 29th August. If you still haven’t had a chance to read through click here! If not, please get in touch with us for a trial subscription to our reports (clientconnect@frontiergroup.info).