This is Frontier’s monthly flagship report covering in detail Sri Lanka’s macroeconomic situation and our key forecasts. The July edition contains our understanding on Sri Lanka’s macroeconomic story and our views for the 2025-2026 period.

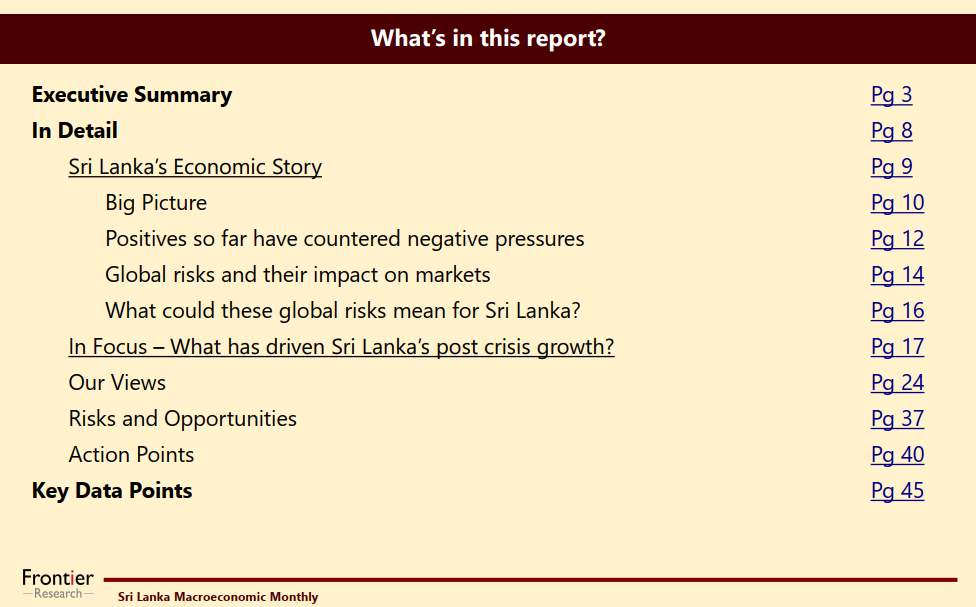

The report is structured to provide an Executive Summary section with key takeaways from the report and a summary of our views on the exchange rate and interest rates. Going into the detailed section provides our overall economic story for Sri Lanka taking into account the latest data and developments. The July story focuses on how Sri Lanka’s strong fiscal and external performances so far can measure up against broad scake global uncertainty, ranging from direct first order impacts to indirect second order impacts.

For our focus for July we take a deeper dive into how Sri Lanka's 2024 and 2025's growth numbers have moved, especially in terms of investment.

All this distills into our exchange rate and interest rate views for 2025 and 2026, which are available as scenarios and best guess narrow ranges on an end-year and quarterly basis. For those wondering about how to make use of all this information in the context of global uncertainty, we provide an updated risk and opportunities map, alongside the key action points we think are relevant to specific client types.For those interested in the key data points on Sri Lanka’s macroeconomic developments, the final section provides the latest on the trade balance, current account balance, reserves, exchange rate, interest rates, and inflation – including our forecast on CCPI inflation up to mid-2026.

Our clients would have received the report to their emails and is accessible on our Athena reports platform since 31st July. If you still haven’t had a chance to read through click here! If not, please get in touch with us for a trial subscription to our reports (clientconnect@frontiergroup.info).